Remember when $32 billion vanished almost overnight? That’s the FTX story in a nutshell.

One day, Sam Bankman-Fried was crypto’s golden boy running one of the world’s largest cryptocurrency exchanges. The next, he was at the center of what many call the biggest fraud since Bernie Madoff.

If you’ve heard about FTX but couldn’t quite follow the meteoric rise and spectacular collapse, you’re not alone. This guide breaks down what FTX actually was, how it worked, and why its implosion sent shockwaves through the entire cryptocurrency ecosystem.

But here’s the real question nobody’s asking: how did so many smart people—investors, regulators, and customers alike—miss the red flags hiding in plain sight?

Table of Contents

FTX’s Rise to Prominence

The founding story and key players

FTX burst onto the cryptocurrency scene in May 2019, founded by Sam Bankman-Fried (SBF) and Gary Wang. SBF, a former Jane Street Capital trader, established FTX after his success with Alameda Research, a crypto trading firm he created in 2017. The exchange was initially headquartered in Hong Kong before relocating to the Bahamas in 2021, seeking a more favorable regulatory environment.

Caroline Ellison, another key figure, joined from Alameda Research where she eventually became CEO. The founding team combined strong technical backgrounds with Wall Street trading experience – a rare mix in the crypto world that helped fuel their rapid ascent.How FTX differentiated from other exchanges

How FTX differentiated from other exchanges

FTX stood out from competitors through several innovative features:

- Sophisticated derivatives trading: Offered complex products like leveraged tokens and prediction markets

- Lower liquidation risks: Implemented a unique “backstop liquidity provider” system

- Unified margin system: Allowed cross-collateralization across positions

- Lower fees: Undercut competitors while maintaining profitability

The exchange targeted both retail users and institutional traders with an interface that balanced simplicity with advanced functionality. This dual approach helped capture market share from both segments simultaneously.

Rapid growth metrics and valuation milestones

The growth trajectory of FTX was nothing short of remarkable:

| Year | Valuation | Daily Trading Volume | User Growth |

| 2019 | Launch | $50-100 million | <100,000 |

| 2020 | $1 billion | $400-600 million | ~500,000 |

| 2021 | $18 billion | $10-15 billion | ~5 million |

| 2022 | $32 billion | $20+ billion | ~9 million |

This explosive growth attracted blue-chip investors including Sequoia Capital, Temasek, and SoftBank, who poured billions into the company across multiple funding rounds.

Celebrity endorsements and marketing strategies

FTX deployed an aggressive marketing strategy featuring high-profile partnerships and celebrity endorsements. The roster included:

- Tom Brady and Gisele Bündchen (equity stakeholders and brand ambassadors)

- Stephen Curry (global ambassador)

- Shohei Ohtani (brand ambassador)

- Miami Heat (arena naming rights for $135 million)

- Major League Baseball (uniform patches for umpires)

Beyond celebrities, FTX allocated significant resources to sports sponsorships, including Formula 1 racing teams and esports organizations. Super Bowl commercials featuring Larry David represented some of the most expensive crypto marketing efforts in history.

The exchange also built goodwill through its philanthropic arm, the FTX Foundation, which aligned with SBF’s effective altruism philosophy and pledged to donate a percentage of trading fees to charitable causes.

Core Services and Features

Trading Products Offered

FTX stood out in the crypto exchange landscape by offering an extensive range of trading products. The platform supported spot trading for over 300 cryptocurrency pairs with deep liquidity. Where FTX truly excelled was its derivatives offerings – perpetual futures, quarterly futures, and MOVE contracts that allowed traders to bet on price volatility rather than direction. Leverage of up to 101x was available, making FTX popular among risk-tolerant traders seeking amplified exposure.

FTT Token Utility and Economics

FTT Token Utility and EconomicsThe FTX Token (FTT) served as the backbone of the exchange ecosystem. Token holders received trading fee discounts on a sliding scale – the more FTT held, the greater the discount. FTT stakers earned a portion of exchange fees, insurance fund contributions, and gained access to IEO opportunities. A regular token burning mechanism used one-third of exchange fees to buy back and destroy FTT, creating deflationary pressure designed to benefit long-term holders.

Innovative Derivatives and Prediction Markets

Beyond standard crypto derivatives, FTX pioneered several innovative products. The exchange launched tokenized stocks, allowing users to trade fractions of shares like Tesla or Apple without geographical restrictions. Prediction markets on FTX enabled betting on everything from presidential elections to cryptocurrency market caps. Volatility products like MOVE contracts gave sophisticated traders tools to profit from market turbulence regardless of direction.

User Experience Advantages

FTX delivered a streamlined trading experience that balanced sophistication with accessibility. The platform featured a clean interface with advanced charting, real-time order books, and customizable layouts. Mobile apps offered full trading functionality across devices. Risk management tools included adjustable liquidation settings and portfolio margin calculations. The unified wallet system eliminated the need to transfer assets between spot and futures accounts, simplifying fund management.

Regulatory Approach in Different Jurisdictions

FTX maintained a complex regulatory strategy across global markets. The main international exchange operated from The Bahamas following earlier relocation from Hong Kong. A separate entity, FTX US, served American customers with a more limited product range compliant with US regulations. The exchange secured licenses in multiple jurisdictions including Gibraltar, Australia, and Cyprus. This multi-entity approach allowed FTX to tailor offerings to local regulatory requirements while maintaining core services in most markets.

The Collapse of FTX

A. Timeline of the downfall

The FTX collapse happened with shocking speed in November 2022. The crisis began when CoinDesk published an article on November 2 revealing alarming financial entanglements between FTX and Alameda Research. By November 6, Binance CEO Changpeng Zhao announced plans to liquidate the company’s FTT token holdings, triggering a bank run.

Within 48 hours, FTX faced a liquidity crisis as customers rushed to withdraw $6 billion. By November 8, withdrawals were halted. The next day, Binance signed a non-binding agreement to acquire FTX, only to back out hours later citing issues “beyond our control or ability to help.”

On November 11, just nine days after the initial report, FTX filed for Chapter 11 bankruptcy. Sam Bankman-Fried resigned as CEO, and John J. Ray III took over to manage the restructuring.

B. The Alameda Research connection

At the heart of the FTX implosion was its relationship with Alameda Research. Both companies were founded by Sam Bankman-Fried, creating an inherent conflict of interest. The CoinDesk report revealed Alameda’s balance sheet was propped up by FTT tokens – the same token created by FTX.

This circular arrangement meant Alameda’s solvency depended on an asset whose value was essentially controlled by FTX. Worse still, evidence emerged that FTX had transferred customer funds to Alameda to cover trading losses, without customer knowledge or consent.

The two entities operated with blurred boundaries despite claims of separation. Trading advantages were given to Alameda on the FTX platform, and customer deposits were reportedly used as collateral for Alameda’s risky trading strategies.

C. Liquidity crisis explained

The liquidity crisis that toppled FTX stemmed from a fundamental mismatch between assets and obligations. When Binance announced its FTT token liquidation, it triggered a market-wide panic. The token’s value plummeted 80% in days, decimating Alameda’s balance sheet.

As customers rushed to withdraw funds, FTX faced an $8 billion shortfall. The exchange simply didn’t have enough liquid assets to honor withdrawal requests because:

- Customer funds had been inappropriately transferred to Alameda

- Assets were locked in illiquid investments and ventures

- The collapsing value of FTT tokens created a death spiral

The crisis revealed FTX had been operating with fractional reserves – a fatal flaw for an exchange promising instant withdrawals and complete security of customer assets.

D. Failed rescue attempts

Desperate to save the company, Bankman-Fried sought emergency funding from various sources. The brief Binance acquisition offer represented the most public rescue attempt, but quickly fell apart during due diligence.

Behind the scenes, SBF frantically tried to secure emergency funding from investors, reportedly seeking $8 billion to cover the shortfall. Venture capital firms that had previously invested in FTX declined to provide bailout funds once the extent of the problems became clear.

Last-ditch efforts included attempts to secure investment from Middle Eastern sovereign wealth funds and discussions with Justin Sun of Tron. A potential deal with rival exchange OKX also fell through within hours.

The failed rescue attempts highlighted how severe FTX’s problems were – no amount of SBF’s legendary charm could overcome the fundamental issues in the company’s finances once they were exposed to scrutiny.

Impact on the Crypto Ecosystem

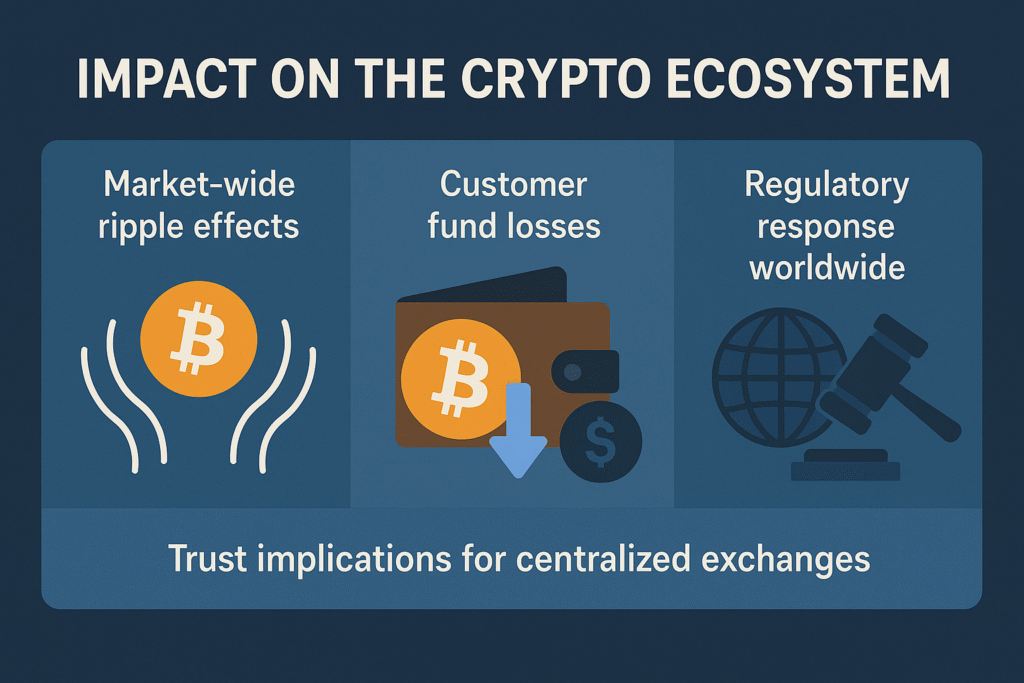

A. Customer fund losses

The FTX collapse left a devastating financial void for customers. Over a million creditors found themselves unable to access their funds when the exchange imploded in November 2022. Court documents revealed a staggering $8.7 billion in missing customer funds – money that was supposed to be safely held but instead was misappropriated through a complex web of loans and transfers to sister company Alameda Research.

Average retail investors lost access to their life savings. Institutional clients saw significant balance sheet damage. The bankruptcy proceedings continue to drag on, with customers still uncertain about how much of their money they’ll ever recover. Current estimates suggest creditors might eventually receive between 60-70 cents on the dollar, though the timeline remains unclear.

B. Market-wide ripple effects.

The FTX implosion triggered an industry-wide contagion. Bitcoin plummeted nearly 25% in the immediate aftermath, while the overall crypto market capitalization shed approximately $200 billion within days.

Several crypto firms with exposure to FTX quickly followed into insolvency:

| Company | Impact |

| BlockFi | Filed for bankruptcy after FTX agreed to acquire it but couldn’t complete the deal |

| Genesis | Suspended withdrawals before eventually filing for bankruptcy |

| Voyager | Rescue deal with FTX collapsed, extending their bankruptcy process |

Market liquidity deteriorated significantly across trading platforms as institutions reduced risk exposure to the sector. The collapse also amplified crypto market volatility for months afterward.

C. Regulatory response worldwide

FTX’s implosion catalyzed aggressive regulatory action globally. In the US, the SEC intensified its enforcement against crypto exchanges, arguing most cryptocurrencies qualify as securities. The CFTC and Department of Justice also ramped up investigations across the industry.

Internationally, regulators implemented stricter controls:

- Singapore mandated better segregation of customer assets

- European Union accelerated work on the Markets in Crypto-Assets (MiCA) regulation

- Japan strengthened its already robust exchange oversight

- Hong Kong revised its crypto regulatory framework to enhance investor protection

These responses significantly increased compliance burdens for exchanges and accelerated the push toward comprehensive crypto regulation worldwide.

D. Trust implications for centralized exchanges

The FTX debacle shattered trust in centralized crypto exchanges. The industry mantra “not your keys, not your coins” gained renewed significance as users rushed to move assets to self-custody wallets.

Exchanges scrambled to rebuild confidence through:

- Implementing Proof of Reserves attestations

- Publishing real-time asset dashboards

- Enhancing transparency around custody practices

- Obtaining additional insurance coverage

Trading volumes on decentralized exchanges spiked 30% in the weeks following FTX’s collapse as users sought alternatives to centralized platforms. Meanwhile, hardware wallet manufacturers reported sales increases of over 300% as self-custody became a priority for crypto holders.

The industry now faces a fundamental challenge in rebuilding institutional and retail trust, potentially reshaping the exchange landscape for years to come.

Lessons for Crypto Investors

Red flags that were missed

The FTX collapse wasn’t a bolt from the blue. Warning signs were everywhere, hiding in plain sight. The lack of a proper board of directors should have raised eyebrows immediately. Legitimate financial institutions have robust governance structures – FTX operated more like a personal fiefdom.

Financial transparency was practically non-existent. No audited financial statements from reputable firms were available, just vague reassurances. The company’s rapid growth and excessive spending on sponsorships and celebrity endorsements created an illusion of stability while masking fundamental problems.

The complex corporate structure spanning multiple jurisdictions? That’s a classic red flag for regulatory arbitrage – choosing the most convenient rules rather than the most protective ones.

Importance of self-custody

“Not your keys, not your crypto” isn’t just a catchy phrase – it’s financial survival advice. Self-custody means maintaining direct control over private keys rather than trusting exchanges to safeguard assets.

Hardware wallets provide significant protection against exchange failures. They store private keys offline, away from potential hacks or mismanagement. The minor inconvenience of managing personal wallets pales compared to the devastating losses many FTX customers experienced.

Self-custody also eliminates counterparty risk. When depositing assets with any third party, exposure to their business practices and financial health becomes unavoidable. The additional control comes with responsibility – proper backup procedures must be established to prevent accidental loss.

How to evaluate exchange security

Security evaluation requires looking beyond flashy marketing. Regulatory compliance across multiple jurisdictions signals commitment to following rules. Insurance coverage specifically for customer assets (not just general business insurance) provides an extra layer of protection.

Transparency in security practices matters enormously. Regular security audits from reputable firms should be publicly available. Proof-of-reserves demonstrations show whether exchanges actually hold the assets they claim.

Cold storage policies reveal how seriously security is taken. The higher the percentage of assets in cold storage, the better the protection against hacks. Multi-signature requirements for withdrawals add crucial verification steps before moving funds.

Due diligence strategies

Effective due diligence means developing healthy skepticism. Researching leadership backgrounds can reveal previous failures, regulatory issues, or lack of relevant experience. Team composition matters – look for balanced expertise across technology, finance, compliance, and security.

User reviews and community feedback often reveal service issues before major problems emerge. Monitoring withdrawal policies helps identify potential liquidity problems – excessive delays or changing requirements can signal trouble.

Diversification across multiple platforms reduces exposure to any single exchange failure. Liquidity needs should be carefully balanced against security – only keep actively traded assets on exchanges while securing long-term holdings in self-custody solutions.

Conclusion

FTX’s meteoric rise and catastrophic fall serves as a stark reminder of the volatile nature of cryptocurrency markets. From its innovative trading features and global expansion to its sudden collapse amid allegations of misused customer funds, FTX’s story highlights the critical importance of transparency and proper governance in crypto exchanges. The ripple effects continue to impact investor confidence and regulatory approaches throughout the entire ecosystem.

For crypto investors, the FTX saga delivers essential lessons about due diligence, risk management, and the dangers of centralized control. Moving forward, prioritize exchanges with proven security measures, transparent operations, and regulatory compliance. Consider diversifying where you store your assets and maintaining control of your private keys whenever possible. While cryptocurrency remains a promising technology, the FTX collapse reminds us that caution and thorough research should guide every investment decision.

Stay updated with the latest news and alerts — follow us at racstar.in