Foreign Direct Investment (FDI) has long been a critical source of economic growth, job creation, and capital inflow for India. However, a sharp dip in net FDI inflows in May 2025, as reported in the RBI Bulletin, has raised eyebrows across economic and political spheres. According to the Reserve Bank of India (RBI), net FDI inflows fell by a staggering 98% compared to the same period last year, largely due to a 24% rise in repatriation of capital by foreign investors.

So, what does this mean for India’s economy? Why are foreign investors pulling their money out? And how does this impact the common man and business ecosystem?

Table of Contents

1. What the RBI Data Says

In its July 2025 Bulletin, the RBI reported the following key statistics regarding FDI for May 2025:

- Net FDI inflows dropped to just $94 million, compared to $4.9 billion in May 2024.

- Gross inflows (total FDI investments) stood at $4.2 billion, down from $5.1 billion last year.

- Repatriation/Disinvestment (when foreign investors withdraw their funds) jumped by 24%, rising to $4.1 billion.

This sharp contrast between incoming investments and outgoing capital highlights a weakening investor sentiment and growing caution among foreign businesses operating in India.

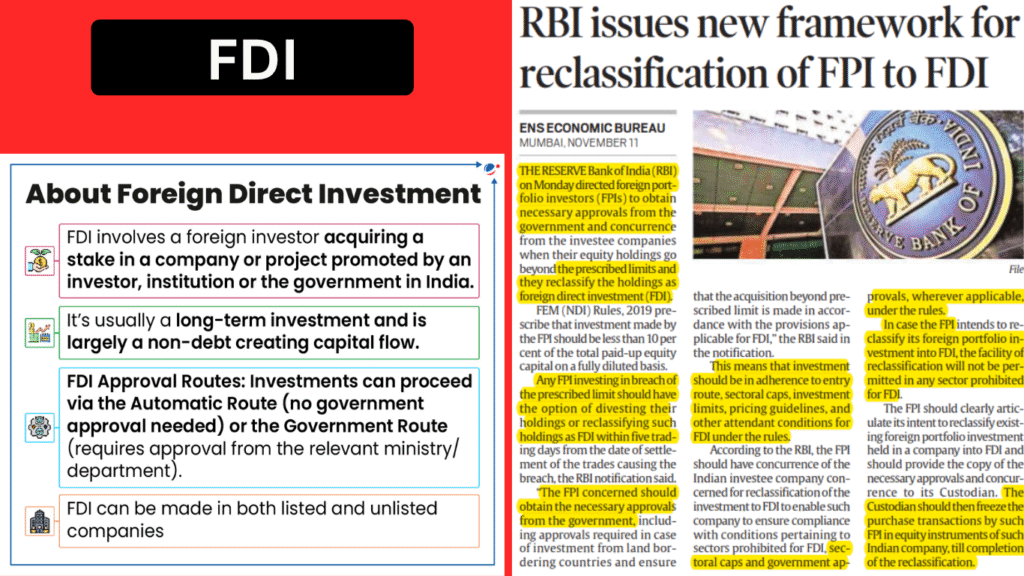

2. What Is Net FDI, and Why Does It Matter?

Before diving into reasons and implications, here’s a quick primer:

- Gross FDI inflow: The total new investment made by foreign companies in Indian businesses or projects.

- Repatriation: The withdrawal or return of previously invested capital by foreign investors.

- Net FDI inflow = Gross Inflow – Repatriation

A positive net FDI indicates confidence in the economy, more jobs, and capital growth. A declining net FDI, especially as sharp as 98%, is a signal of worry.

3. Why Are Net FDI Inflows Falling?

Several factors are believed to be behind this concerning drop:

1. Global Economic Uncertainty

The world is currently navigating through multiple economic headwinds:

- Slowdown in developed markets

- High global interest rates

- Geopolitical tensions (Ukraine-Russia, Middle East, China-Taiwan)

These factors have made foreign investors more risk-averse. They are increasingly pulling funds from emerging markets like India to safeguard their capital in stable economies or home markets.

2. Policy Uncertainty in India

While India has improved in ease of doing business, recent taxation issues, retrospective changes, and sectoral policy flip-flops have added to investor anxiety. For instance, regulatory overhauls in sectors like e-commerce, data privacy, and telecom are seen as unpredictable by investors.

3. Profit Booking and Exit Strategy

After a high investment cycle during 2020–2023 (especially in tech, fintech, and edtech), some investors are now cashing out. They are exiting mature investments either due to profit realization or lack of growth scalability in certain sectors.

4. Rising Cost of Capital Abroad

With rising interest rates in countries like the US, UK, and EU, foreign firms find better returns on domestic investments compared to Indian markets. This has led to capital pullouts from emerging markets.

4. What Is Repatriation, and Why Has It Increased?

Repatriation refers to foreign investors selling off their stake and moving the capital back to their home country.

In May 2025:

- Repatriation touched $4.1 billion, up 24% year-on-year.

- Sectors like IT services, pharma, and fintech saw maximum exits.

Reasons for this repatriation spike include:

- Completed investment cycles (5-7 years)

- IPO exits by foreign VC/PE funds

- Global liquidity crunch

- Revaluation of risk portfolios

Essentially, investors are rebalancing their exposure across countries, and India is facing outflows as a result.

5. Sector-Wise Breakdown: Where Did the Money Go?

According to industry estimates and RBI patterns:

| Sector | Trend |

| Startups/VC-backed tech firms | Witnessed pullout due to saturated market |

| Manufacturing/PLI-linked industries | Mixed sentiment, with some slowdown in new investments |

| Real Estate and Infrastructure | Repatriation due to delayed projects |

| IT and Pharma | High exit rate, despite solid fundamentals |

The lack of new large-scale FDI proposals further aggravated the drop in net inflows.

6. 🇮🇳 What This Means for the Indian Economy

A drop in net FDI inflows has multiple consequences:

🔸 Rupee Pressure

A fall in dollar inflows reduces foreign exchange reserves, putting pressure on the Indian Rupee, leading to depreciation.

🔸 Stock Market Volatility

When foreign investors exit, it often triggers a sell-off in the stock markets, especially in mid- and small-cap stocks.

🔸 Slower Job Creation

FDI is a significant job creator, particularly in manufacturing, IT, and real estate. A decline affects employment and new opportunities.

🔸 Slowdown in Economic Momentum

FDI is critical for technology transfer, capital infusion, and global integration. Weak inflows could hamper GDP growth in the medium term.

7. What Needs to Be Done?

To restore investor confidence and reverse the FDI outflow trend, India needs a coordinated policy response. Here’s what could help:

- Policy Stability – Consistent, transparent regulations across sectors.

- Ease of Repatriation – Clear tax rules and smooth exit options.

- FDI Reforms – Further liberalization in restricted sectors like defence, insurance, etc.

- Boost Investor Confidence – Proactive outreach programs and dispute resolution mechanisms.

- Enhance Infrastructure – Power, roads, digital connectivity must keep up with global expectations.

Conclution

The 98% drop in net FDI inflows for May 2025 should not be viewed as an isolated data point—but as a warning sign for India’s economic policymakers. With the right reforms and investor-friendly approach, India can still maintain its status as one of the world’s most attractive investment destinations. However, urgency is key.

Stay updated with the latest news and alerts — follow us at racstar.in